Buying

BUYING

THE BUYING PROCESS IN 9 STEPS

Helping You Find Your Dream Home

CHOOSE A BROKER

It’s important to ask potential brokers questions relating to their experience and routines, and to listen for the questions they ask you to get a feel for if they’re really intent on understanding your needs.

Experience in your preferred neighborhood and/or style of home is important, but so is the comfort level between broker and client, because buying a home is a highly personal experience. Your broker should be someone you like, trust, and respect—and who feels the same way about you.

1

GET PRE-APPROVED FOR A MORTGAGE

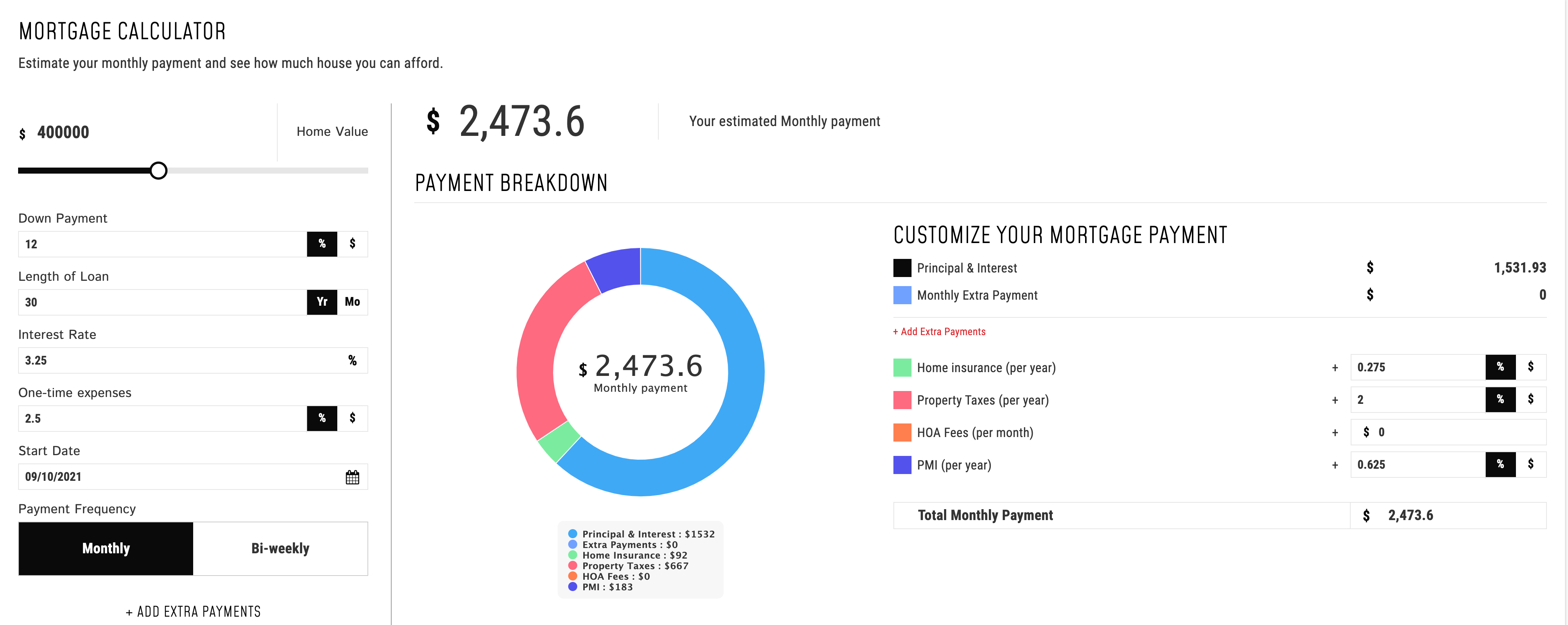

In today’s home-buying environment, a mortgage pre-approval is essential. It not only lets you know what you can afford to buy, but also demonstrates to sellers that you are a willing and able buyer. What’s more, it gives you an important head start in securing an actual loan commitment. There is a mortgage calculator near the bottom of this page.

2

CREATE A WISH LIST

Almost every home purchase involves some degree of compromise. There are many variables to think about depending on your lifestyle, budget and future plans, but some universal considerations include:

Location – Consider important factors such as schools, transportation, and neighborhood amenities like shops, restaurants, and parks.

Type of Home – There are a variety of housing styles to consider. Weigh the pros and cons to narrow your focus.

Features and Amenities – Think about your wants and needs, such as garage parking, hardwood floors, outdoor space, etc.

3

FIND YOUR HOME

At this stage of the game, you are ready to begin your home search. Here’s what you can expect to do:

Review Listings – Your broker will present you with available listings. Beyond price and property attributes, pay close attention to data like property taxes, market time, and monthly assessments for condos and townhomes.

View Properties – Your broker will schedule showings and accompany you on appointments.

Open Houses – If you’re attending open houses without your broker, be sure to mention that you are being represented by an @properties broker. This will save you from being inundated with calls from other brokers trying to represent you.

Compare Properties – Provide candid feedback to your broker after every listing you see so he or she will be able to adjust their parameters in order to present you with alternatives. When you find a home that suits your needs, your broker will prepare a Comparative Market Analysis (or CMA) to help you formulate your offer.

4

MAKE AN OFFER

When you find a home, it’s important to act quickly and make an educated offer based on the strategy you and your broker have discussed. Your broker will draw up a contract that includes your offer price and other terms and contingencies. Here are some of the most common elements of a real estate contract:

Price – The market will determine the final price, but your broker will help you formulate an offer based on current market conditions and comparable listings and sales.

Mortgage Contingency – A mortgage contingency stipulates that you will buy the home subject to obtaining a mortgage. If you cannot obtain a mortgage, and the seller will not agree to finance the sale, then the contract will be void.

Home Inspection Contingency – A thorough inspection of the property by a licensed home inspector protects you against structural or material problems that may not be detectable in a casual walk-through.

Attorney Approval – Attorney approval is generally a one-week period in which your attorney can review the contract and suggest alterations to help protect you from any undue obligations. An attorney’s review is always highly recommended.

Earnest Money – Earnest money is a deposit, given to the seller, which secures the contract until the closing. If the sale does not go through due to contingencies covered in the contract, then the earnest money may be returned to the buyer.

Closing Date – This is usually the date the seller must vacate and the buyer may occupy the property. Flexibility on the closing date can give a buyer a big advantage over other potential buyers.

5

NEGOTIATE COUNTEROFFERS

In most transactions, there’s a fair amount of offers and counteroffers. Your broker will draw upon his or her experience and market knowledge to offer sound advice during a negotiation, and he or she can also serve as a buffer between the buyer and the seller/seller’s broker.

6

CONTRACT TO CLOSING

There are dozens of loose ends to tie up between signing the contract and closing the sale. Your broker will coordinate and oversee the following steps:

- Deliver earnest money with the seller or seller’s agent

- Recommend and schedule a home inspector and accompany the buyer on the inspection

- Recommend real estate attorneys

- Obtain important documents, such as property disclosure forms and condominium documents (budget, declaration, condo association minutes), and deliver them to the buyer and buyer’s attorney

- Recommend mortgage brokers and helpexpedite the loan-application process

- Monitor all contingencies to ensure that they have been met

- Recommend service providers for moving, home-improvement and repairs

- Schedule a final walk-through. Both the buyer and buyer’s agent should be present

- Coordinate and attend your closing

7

CLOSING

Your broker will work closely with you, your lender, your attorney, and the seller’s broker to make sure everything is in place for a smooth and efficient closing.

Typically, a day or two prior to the closing, your lender will forward all loan documentation to the title company and let you know the amount required to close. You will be responsible for bringing the balance of your down payment and closing costs (such as lender fees, title company fees, and state and city transfer taxes) to the closing in the form of a cashier’s check. At the closing, your attorney will guide you through the documents you need to sign, including the bill of sale, the deed, and the affidavit of title.

8

AFTER YOU BUY

One of our core values is “Everything is Relationship”. We maintain relationships with clients long after the closing. That means we’re always glad to help you find service providers and tradesmen to perform work on your home or just make life a little easier.

As you’re getting settled, here are a few situations you may encounter in the coming months and years that are important to think about.

- Rebuilding Your Savings and Maintaining Financial Discipline – It’s important to set up an automatic electronic payment with your mortgage lender, to avoid costly penalties associated with late payments. Buyers should also make a plan for gradually rebuilding their savings account.

- Refinancing – Keep an eye on interest rates even after you purchase your home. If rates go down, you may be able to save money by refinancing. Keep in mind refinancing is a major financial transaction with important implications. So be just as diligent in a refinance as you were in securing your original mortgage.

- Home Improvement – Most new homeowners have at least a few projects they want to tackle once they move in. Your broker has the network and resources to help you find a variety of service providers to perform work on your home.

9

Contact

Ready To Take The Next Step?

I would love to get to know more about you and your needs! Feel free to use any of the options here to get in contact with me!